Benjamin Graham's Wise Investing Strategies: A Guide for Beginner Investors

Looking for the secret to investing success? In his book, The Wise Investor, Benjamin Graham lays out the key principles for investing success. His philosophy is simple but powerful, and easy to understand and put into practice, even for novice investors.

Be sure to read the article below before reading this article!

Who is Benjamin Graham, author of The Intelligent Investor?

1. Learn from the past to understand the present.

Success in investing depends on analyzing the current situation and formulating future strategies based on past experiences. Graham emphasizes that studying past investment patterns and trends is essential for future success.

2. Distinguish between investing and speculating.

Investing is the act of securing safety of principal and returns through thorough analysis. On the other hand, speculation is a risky behavior that only seeks short-term gains. Graham advocates that investors should clearly distinguish between investing and speculation, and develop a safe investment strategy with a long-term perspective.

3. Create your own investment principles.

Successful investing depends on having your own set of investment principles and sticking to them. Graham emphasizes the importance of identifying your investment personality and goals, and creating an investment strategy that aligns with them.

4. Have the right investing temperament.

The most important factor for investing success is having the right investing temperament. Graham says that having a cool head, rational judgment, and not letting emotions get the best of you is essential for successful investing.

5. Gain investment wisdom from The Wise Investor.

Benjamin Graham's The Wise Investor is an essential book for understanding the nature of investing and formulating a sound investment strategy. It is the best guidebook for imparting investment wisdom to all investors, not just beginners.

Investor Patience vs. Investment Success

This chart illustrates the relationship between investor patience and investment success.

Chapter 1: Investing and Speculating

Distinguishing between investment and speculation: the foundation of successful investing

A clear distinction between investing and speculating is essential to the success of investing. Investing is the act of securing the safety of principal through thorough analysis and seeking sufficient returns over the long term. Speculation, on the other hand, is the act of taking advantage of short-term price fluctuations to make a profit, and is associated with high risk. Investors should understand the essential difference between investment and speculation and make investment decisions based on sound judgment.

Performance Expectations for Defensive Investors

A defensive investor is an investor who seeks to preserve principal as their primary objective and seeks stable returns with as little speculation as possible. They take a long-term view and aim to grow their wealth through steady investments.

1965: The Golden Age of Investing

The year 1965 was one of the golden years in the history of investing. The U.S. economy was growing, and corporate profits were steadily increasing. In this environment, both bonds and stocks offered high returns.

Bonds: In 1965, you could expect a pre-tax return of about 4.5% per year from a well-rated bond investment, which was a very attractive return compared to prevailing interest rates at the time. Long-term bonds, in particular, offered high coupon rates and guaranteed principal at maturity, which allowed investors to pursue both stable returns and principal safety.

Stocks: In 1965, investors could expect a pre-tax return of around 7.5% per year from investing in blue-chip stocks, which was higher than bond yields and an attractive investment option. In particular, stocks of companies with high growth potential offered even higher returns through higher dividends and stock price appreciation, which allowed investors to pursue wealth growth over the long term.

A balanced portfolio of bonds and stocks: Investors were able to build their investment portfolios with the right mix of bonds and stocks in the right proportions. In 1965, an investor could expect a pre-tax return of about 6% per year if they invested in a 50:50 ratio of bonds and stocks. That was a return that wasn't as safe as investing in bonds, but it wasn't as risky as investing in stocks either. A balanced portfolio allowed investors to seek a stable return while spreading their risk.

Post-1965: Increased volatility in bond yields

After 1965, bond yields rose to record levels before peaking in 1970 and falling sharply. This was the result of a combination of factors such as the Vietnam War leading to increased US government fiscal deficit, inflation, and rising interest rates by the Federal Reserve to curb inflation. These changes had a major impact on the bond market, leading to falling bond prices, rising bond yields, and difficulty for investors in earning stable returns from bond investments.

Mid-1971: Signs of Recovery

In mid-1971, bond yields began to rise again as economic conditions improved. The stock market also showed signs of recovery. By mid-1971, a well-rated bond investment could earn a pre-tax return of about 8% per year, lower than the 1965 level but a significant recovery from the declining returns since 1970. Investing in blue-chip stocks could generate a pre-tax return of about 7.5% per year, the same as in 1965 and a significant recovery from the declining returns since 1970.

Investment strategies

In mid-1971, it was still important for investors to construct an investment portfolio with the right mix of bonds and stocks in the right proportions. Investors needed to consider their investment goals, risk tolerance, and investment knowledge and experience to choose the right investment strategy.

Implications

Past investment returns are no guarantee of future returns. Investors should pay close attention to market conditions and develop an investment strategy that fits their investment goals and risk tolerance. It is important to invest for the long term and to be consistent.

Conclusion

By analyzing the expected returns of defensive investors in 1965, post-1965, and mid-1971, we can see that investment markets are volatile. Since volatility is psychologically painful for defensive investors, a portfolio balanced between bonds and blue-chip stocks will perform well over the long term if the defensive investor's goal is to seek stable returns and preserve principal.

Defensive Investment Portfolio Strategies

1. Join a Fund with a Good Track Record

For investors who lack investment experience or have limited time to invest, joining a well-performing fund is a good option. You can utilize the specialized knowledge and experience of fund managers to pursue stable returns, and reduce risk by diversifying your investments across a variety of assets.

How to Choose a Fund with a Good Track Record

Affordable Price

| Fee Comparison | Compare the cost of the fund, including management fees, maintenance fees, and trading fees, with other funds to ensure competitiveness. |

| Impact of Fees | Analyze the impact of fees on investment returns and choose funds with low fees to maximize investment returns. |

Safety and Stability

| Analyze Risk Indicators | Analyze risk metrics such as Sharpe ratio, information ratio, and beta to assess a fund's resistance to market volatility. |

| Maximum Loss Analysis | Analyze a fund's maximum loss potential and select a fund that matches your risk tolerance. |

| Downcycle Return Analysis | Analyze how a fund has performed in down markets to assess its stability. |

Consistency of Investment Strategy

| Check the Investment Philosophy | Ensure the fund manager's investment philosophy is consistent with Benjamin Graham's value investing philosophy. |

| Analyze the Investment Style | Analyze the investment style of the fund and select one that matches your investment objectives. |

| Portfolio Analysis | Analyze the fund's portfolio composition and perform a valuation of the stocks it invests in. |

Past Performance

| Analyze Long-term Performance | Analyze a fund's long-term performance (5 years or more) to assess its consistency. |

| Compare Returns to the Market | Analyze the fund's return relative to the market and select funds that generate higher returns than the market average. |

| Analyze Risk-adjusted Returns | Evaluate a fund's efficiency by analyzing risk-adjusted return metrics such as the Sharpe ratio and the information ratio. |

Additional Considerations

| Fund Size | Select a fund that is appropriately sized. |

| Duration | Prefer funds with a longer operational history. |

| Liquidity | Check the liquidity of the fund to ensure ease of selling your investment. |

| Fund Manager Experience | Choose a fund run by a competent manager with relevant experience and track record. |

2. Use a Good Investment Advisor

An investment advisor will construct and manage a customized investment portfolio for you, taking into account your individual circumstances. Expert advice can increase the likelihood of achieving your investment goals and reduce the time and effort involved in investing.

How to Choose a Good Investment Advisor

- Qualifications and Education: Check for investment-related certifications, education, and specialized training.

- Experience and Track Record: Analyze years of experience, past investment performance, and key achievements.

- Team of Experts: Ensure the team consists of experts in investment analysis, portfolio management, risk management, etc.

- Value Investing Philosophy: Make sure the advisor's philosophy aligns with Benjamin Graham's value investing philosophy.

- Investment Goals and Risk Tolerance: Ensure the advisor offers strategies that align with your goals and risk tolerance.

- Transparency: Ensure transparent information about the investment process, strategy, portfolio composition, and investment decisions.

- Newness: Be cautious if they are new, and check their track record and reputation.

- Regulatory Compliance: Check for compliance with relevant regulations.

- Customer Complaint Cases: Check for past customer complaints and resolutions.

- Fee Structure: Clearly identify advisory fees, performance-based fees, and other costs.

- Fee Levels: Check if fees are competitive compared to industry averages.

- Performance versus Fees: Analyze cost-effectiveness by evaluating investment performance relative to fees paid.

| Expertise and Experience |

|

|---|---|

| Alignment of Investment Philosophy |

|

| Transparency and Trustworthiness |

|

| Fees and Expenses |

|

3. Use of Fixed Purchase Accruals

| Benefits | Description |

|---|---|

| Long-term Wealth Growth | Expect returns above the market average. |

| Maintain Investment Discipline | Enable rational investment behavior and avoid emotional decisions. |

| Averaging Investment Costs | Minimize costs by averaging purchase prices over market fluctuations. |

| Simple and Convenient | Easily applicable for anyone. |

Aggressive Investors' Strategies and Return Expectations

Bill Eckman

Bill Eckman is a seasoned investor with decades of experience in the financial markets. As the founder of Eckman Capital, he has built a reputation for his disciplined investment approach and ability to identify undervalued assets. Eckman's investment strategies often focus on long-term growth opportunities, and his insights are highly regarded by fellow investors.

1. The Concept and Goals of Aggressive Investing

The term "aggressive investor" refers to investors who aim for high returns. These investors apply a variety of strategies to achieve their goals, ranging from broad-based trading to short-term and long-term stock picking. However, each method has elements that require careful consideration, and it is important to understand and apply them well.

2. Types and Characteristics of Aggressive Investment Strategies

-

Trading

Seeking profits by buying in bull markets and selling in bear markets.

- Pros: High returns can be achieved in a short period of time.

- Cons: To be successful, your short-term and long-term forecasts must be correct, and it's hard to get a competitive advantage with this method because the performance is already publicly available.

-

Short-term Stock Picking

Buying stocks in anticipation of favorable announcements.

- Pros: High returns in a short period of time.

- Cons: Requires quick information acquisition and analytical skills, and may be less likely to succeed due to high competition.

-

Long-term Stock Picking

Investing in the future growth potential of past growth companies.

- Pros: Higher returns over the long term.

- Cons: Requires accurate company analysis skills, and long-term investments may limit liquidity.

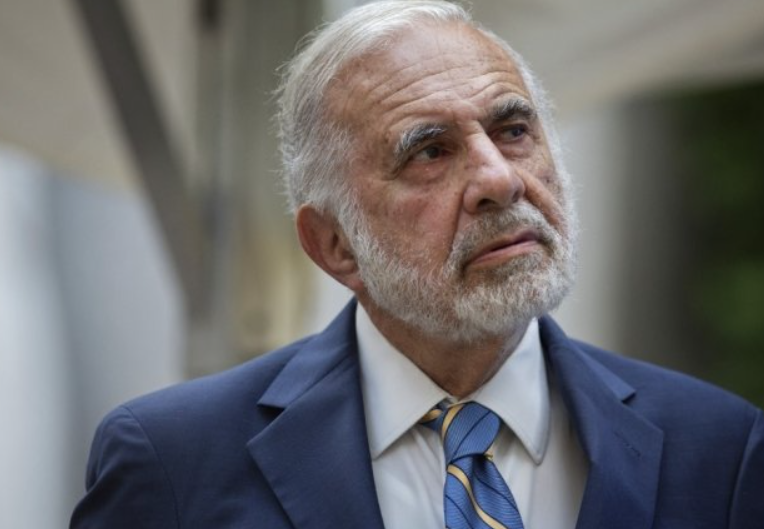

Carl Icahn

Carl Icahn is a billionaire investor known for his activist approach to investing. Through his investment firm, Icahn Enterprises, he has taken significant stakes in numerous companies, often advocating for changes in management or strategic direction to enhance shareholder value. Icahn's bold moves and outspoken nature make him a prominent figure in the financial world.

3. Expected Returns of Aggressive Investments

Aggressive investing can provide high returns, but it also comes with high risk. Depending on market volatility, investment returns can fluctuate significantly, and the potential for investment loss is high.

4. Key Factors for Aggressive Investment Success

- Excellent Market Analysis and Forecasting Ability

- Quick Information Acquisition and Analysis Ability

- Excellent Company Analysis Skills

- Extreme Patience

5. Practical Application Guidelines: Discovering and Investing in Undervalued Stocks

- Finding Sound Companies that are Not Popular on Wall Street

- Wait for Investment Opportunities with Extreme Patience

- Prudent Risk Management

The Citadel's Ken Griffin

Ken Griffin, the founder and CEO of Citadel, is a prominent figure in the investment world. With his exceptional leadership and strategic vision, Griffin has propelled Citadel to become one of the most successful hedge funds globally. Known for his innovative approach to investing and risk management, Griffin's insights and decisions greatly influence the financial markets.

6. Realistic Evaluation of Aggressive Investment Strategies

Aggressive investing is an attractive investment strategy, but it also involves high risk. Investors should carefully select an investment strategy based on their investment goals, risk tolerance, and investment capabilities. To successfully implement an aggressive investment strategy, it is essential to have excellent market analysis skills, the ability to quickly acquire and analyze information, good company analysis skills, extreme patience, and prudent risk management.